Martin Lewis has revealed the exact date your student loan debt will be wiped out and you’ll no longer be asked to make contributions towards it.

And it’s no surprise that the date differs for lots of us, given that there are varying plans depending on when you started university. So it’s a little bit more complicated than you might be thinking.

The vast majority of going to uni will take out student loans to cover their course fees, with other maintenance loans also taken to help cover general living costs.

.jpg)

It means that when graduating, students enter the world of work with thousands of pounds of debt to their name. And that debt has to be repaid.

Once in work and earning over a specific amount – again, this alters depending on which plan you’re on -, you will start paying back the cash that helped get you through university. It’s effectively a progressive graduate tax, with the amount you pay dependent on what you earn.

But you won’t be doing it forever, with the debt wiped out after specific periods of time.

What has Martin Lewis said about student loans?

Martin Lewis, who to many is the United Kingdom’s top financial guru, took to X (formerly Twitter) earlier this year to speak about the issue. And with students having just started university, or returning for another year, the timing to revisit his advice couldn’t be more appropriate.

“If you’re one of millions of people currently repaying your student loan the big question I get from many is ‘when does it wipe’,” Lewis posted over the summer.

“It’s worth remembering there are four different reasons you will stop repaying the student loan. The first and the most obvious is that you’ve cleared what you borrowed plus the interest. There’s nothing left to repay, you stop repaying.

“The second is you’ve hit the time limit. And all different variants of student loans have a time limit, it could be 30 years, could be 40 years, age 65, that depends, and I’m going to run through the detail on that.

“The third is if you die; if you die, your student loan does not form part of your estate, the people who inherit from you will not have to pay it off, it’s simply wiped, and never needs paying.

“And the final one, which is somewhat similar, is if you were to get a permanent disability or illness that were to stop you from ever working again, you may be able to apply to get your student loan wiped at that point.”

Different end dates depending on where you studied and when

Lewis explains that your student loan debt will be wiped in relation to where in the UK you studied, as well as when you began your degree.

For every student who has started studying in England since September 2023, Lewis states that your loan will be ‘wiped 40 years after the April after you left university’.

It’s different for those who studied between 2012 and 2022. If that is you, your debt will be wiped after 30 years. This is also the same for Welsh students since 2012 and those studying in Scotland from 2007.

If you chose to study in Northern Ireland after 2012, your loan will be wiped after 25 years.

For the older graduates among us – those who went to university in England, Wales, and Northern Ireland between 1998 and 2005 -, your loan doesn’t end after a certain period of time. Instead, it ends once you hit the age of 65.

“If you started between 1998 and 2006 in Scotland, your loan wipes the earlier of 30 years after the April after you left university OR when you hit age 65,” Lewis added.

“If you started between 2006 and 2011 in England, Wales and Northern Ireland, it’s 25 years after the April after you left university.

Martin Lewis has issued a huge refund warning to millions of people who have student loans and it could see a hefty sum land back in your back account.

When we go to university, most of us take out academic and maintenance loans to pay for the course we’re studying and to help us live through the three or four years that it takes to get an undergraduate degree under our belts.

But it isn’t cheap, with tuition fees in England and Wales sitting at £9,250 a year.

When you graduate, you have to start paying back your student debt, which will be in the tens of thousands for modern students. How much you pay and when you pay depends on how much you earn.

Unfortunately for some, they end up paying too much. Enter the advice of Martin Lewis, who this week through his Money Saving Expert (MSE) newsletter explained about a new online tool we can use to reclaim anything we’ve overpaid.

What has Martin Lewis said?

“Student loans, like tax, are repaid via the payroll – but only if you earn over a threshold, and what you pay is in proportion to earnings,” Lewis writes in his latest MSE newsletter.

“And just as millions can reclaim tax overpayments, many uni leavers can reclaim unwittingly overpaid student loans.

“Our Freedom of Information (FOI) requests indicate that over four tax years (6 April 2019 to 5 April 2023) likely more than four million overpaid, and many more did before and since.”

This isn’t the first time Lewis has flagged this issue, with it previously going viral with numerous success stories.

One of them belonged to an MSE reader called Kayleigh, who messaged Lewis saying: “I wanted to thank you. I’ve just found out I’m due just over £800 through having made five repayments to my student loan when I hadn’t reached the yearly threshold.”

Reasons for overpaying your student loan

One of the biggest reasons for overpaying is that you repaid some of your student loan despite not earning enough in the year. Given most people are paid monthly, that figure is taken as one twelfth of the annual figure and taxed accordingly – but obviously, not everyone’s work is as regular and salaries change.

Other instances have included people repaying their student debt too early and others being on the wrong student loan payment plan.

How to reclaim if you’ve overpaid

Lewis says: “There’s no time limit here either, so even if this was a decade ago, you can still do it.

“If possible, gather old payslips, your payroll number and a PAYE reference number. But if you don’t have those, don’t let it put you off – this can often be done in a phone call, and now a new system allows some of the claims to be done online.

To do it online, sign in to your repayment account and select ‘request a refund’. The system will then check previous tax years for you and flag where you might be eligible.

Lewis does say that overpaying on normal loans is a good thing as it means you clear the debt quicker and pay less interest.

Martin Lewis is here with an ‘urgent’ warning to every student in England. And it’s one you really shouldn’t ignore.

Every week, the Money Saving Expert founder sends out his latest tips and tricks when it comes to saving cash; some of which are pretty easy to follow.

Just last week, money man Lewis explained your compensation rights if you’ve flown on a delayed fight in the last six years. And let’s not forget about the cats or the air fryers.

Hidden some way among other tips Lewis and his team are urging you to follow is an ‘urgent’ warning to all students studying in England (don’t worry for now, Scots).

Earlier this year he told students in the UK they should prepare to be worse off when it comes to student living loans in England; commonly called a maintenance loan.

While they are set to increase by 2.5% in September this year – something that seems to be an increase – it’s ‘yet another real-term cut’.

Despite the increase from the start of the new academic year, the MSE team says students are going to lose more than £1,000 in real money due to continuous inflationary worries.

Despite this cut, Lewis’ new warning is here to make sure you get the money in the first place. Regardless of whether it’s a cut or not, having nothing is obviously going to leave you in dire straits.

In the email, Lewis says: “English students starting this year need to apply by Friday (17 May) to be sure of getting their student loan funding for the start of term.”

Fear not if you’re already at university, as the deadline for students continuing their studies is 21 June, meaning the warning only really applies for those hoping to head to university for the first time this September or October.

Students applying for new starter loans will be taking out something called a ‘Plan 5’ loan, something Lewis says will increase costs by more than 50% for the typical graduate.

He explains: “You repay more on the same earnings than predecessors; £207 a year, every year, more if you earn over the old threshold. You repay for longer; the loan wipes after 40 years, not 30.

“The new system leaves many who start university straight after school still repaying it into their 60s. Many typical graduates will pay over 50% more than under the prior system and a few double.

“The only people who gain from the changes are the highest-earning university leavers (roughly the top 25%) who would’ve cleared their loans under the old system. This is because repaying more each year means you repay quicker, and there’s less interest, thus less repaid in total.”

Lewis stresses that ‘this isn’t a reason not to go to university if it’s right for you’, adding: “As daunting as this may feel, the fact university may be more expensive isn’t a reason not to go if it’s right for you. University isn’t just about the finances. There are many other gains – which will be life-changing for some – and, on average, graduates do earn significantly more than non-graduates, so there is a balance.

“Yet the increase in likely cost for many is certainly a reason for you to understand how the finances work, and to examine whether university is the right choice. Could an apprenticeship or another option be better?”

Martin Lewis has issued an update after warning everyone who bought a car before 2021 that there could be ‘billions’ owed.

Yep, the nation’s favourite Money Saving Expert has always got our backs to make sure we’re being smart with our cash. And he doesn’t just drop us an instruction and leave us, him and his team always seem to be there.

At least we can rely on something, right lads?

So, many months ago, Lewis warned that those who purchased a car with a PCP or a finance agreement between 2007 and 2021 could be affected as drivers might be able to claim compensation due to the results of a Financial Conduct Authority (FCA) investigation.

.jpg)

Sheldon Mills, executive director of consumers and competition at the FCA, said: “We are taking a closer look at historical discretionary commission arrangements in the motor finance market following a high number of complaints from customers, which are being rejected by firms.

“If we find widespread misconduct, we will act to make sure people are compensated in an orderly, consistent and efficient way.”

And earlier today on X, Lewis issued an update on his warning as people have still got another year to get their complaints in.

He wrote: “Motor finance misselling update: @TheFCA just announced while it’ll announce it’s ruling in May 2025 firms will have until December 2025 to deal with complaints.”

Lewis previously explained the whole thing to the BBC as he warned car owners:

“What was happening at that point is the lenders who organised the finance were saying to the car dealers ‘the commission is discretionary,’” he said.

“In other words, if you want more commission on these finance products – which is why they were being more heavily sold – you can simply increase the cost of the finance and you will get more commission.

“Many of them did so and it wasn’t declared, so the consumer was not aware quite what enormous sums were being paid in commission to car dealers for this type of finance.”

He continued: “Clearly this means getting complaints in, if you were mis-sold, is going to be crucial.

“It should be noted, part of the announcement is the FCA has put a freeze on firms handling complaints for now, so if you complain now they don’t have to do anything, but my provisional thoughts are it is worth it for people who think they’ve been mis-sold getting in a complaint now as a marker.”

So, if any of this applies to you, the best thing to do is just get your complaint in when you can.

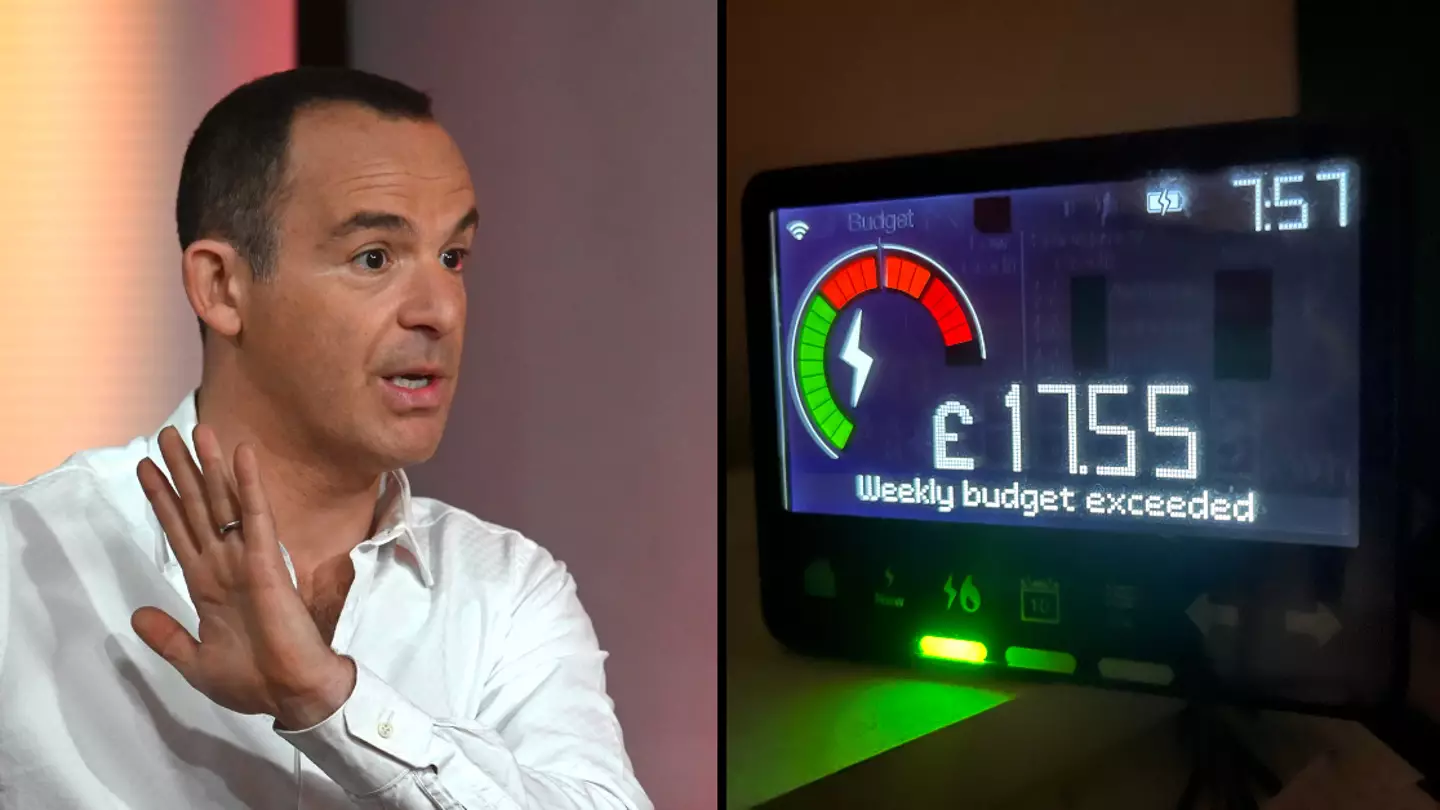

Martin Lewis has issued a one week warning to all energy customers across the UK, which includes those who are with the likes of Octopus Energy, British Gas, Eon, OVO, or EDF.

It has been a turbulent couple of years when it comes to paying for gas and electric in the UK, with prices sent sky high across Europe in the aftermath of Russia’s invasion of Ukraine.

With the situation calmer than it has been in recent years, we’re not quite out of the woods with the cost of living crisis and into a period of calm just yet, with prices still fluctuating significantly every quarter.

That’s due to something called the energy price cap, which for autumn will see energy bills increase significantly for households across the country.

The energy price cap is set by the UK’s energy regulator, Ofgem.

It is the limit the amount that an energy supplier can charge for their default tariff. In other words, the total you will pay if you use your gas and electric.

As it stands, the cap is sat at £1,568 a year for a typical home across Great Britain.

In real terms, this is down significantly from where it was in October 2023 where it sat at £1,834.

What is Martin Lewis warning?

In his latest Money Saving Expert newsletter, Lewis has given a one week warning regarding the energy price cap.

That’s because it’s on the rise; increasing significantly by 10 percent. It’ll go up from 1 October, which is next Tuesday.

In highlighting the price cap, Lewis has alerted customers to one offer available that can save you from paying the 10 percent increase immediately.

“EDF has just launched its Essentials Fixed Oct25 one year fix for new and existing customers, locking in the current Price Cap in every region for a year,” Lewis writes.

“As the Price Cap will rise next Tuesday (1 October) by 10 percent, this means an almost immediate saving.”

Should you fix for a year?

If you fix your energy bill for the next year, it means you won’t be subject to changes to your bill.

That might be a good thing, given that predictions from analysts at EDF and Cornwall Insight say you will pay 11 percent more in the next year if you stay with the price cap fluctuation.

In October, the price cap will rise to £1,717 per year, which is an increase of £149 per year. So if you fix using the likes of EDF’s deal, that’s an immediate saving.

For those looking to switch and fix, Lewis previously said: “Many cheap fixes are disappearing, so waiting may mean you lock in at a higher rate. Of course, if world energy rates drop, prices could be cheaper by then, but there’s no way of knowing.

“Plus, in competition terms, firms know that once October hits, more expensive fixes will look relatively better compared with the new higher price cap. So our best guess is if you’re doing this for peace of mind, sooner is likely safer.”